📜 A Beginner's Guide to Insurtech in France

How French Risk-Aversion could be their Greatest Asset

Welcome to Startup ROI, where we explore global technology trends and how they manifest themselves in France 🇫🇷 . Whether you're an entrepreneur, investor or tech enthusiast, I'm glad to have you here! 📩 Get in touch

📌 If you are a startup interested in being featured or a VC interested in collaborating, please reach out directly: bonjour@startup-roi.com

Listen to this article (and all previous articles) wherever you get your podcasts

Preface: Underinsured

During my undergraduate studies, I made a point to secure summer internships each year. Aside from putting some money in my pocket, it seemed like the best way to reliably test several career paths. Unlike many of my peers, I was absolutely clueless as to what type of work I wanted to pursue. This was reflected in the range of internships I ended up taking (and I suppose has extended into my career as evident on my wide-ranging CV). There were two experiences that informed my path and in hindsight may have led me to writing this very essay.

Between sophomore and junior year, I worked at New York Life Insurance, a Fortune 500 company with an enduring legacy. I took the offer mainly because I wanted to live in Manhattan with my friends, but left with confidence that I had no desire to join a massive insurance firm. In fact, I spent most of that summer goofing around with fellow interns in between processing claims.

The following summer, I pivoted. Hard. In the most unlikely series of events, I was invited to live in Malibu, California with one of the founders of RapGenius, a hip-hop lyric annotation website, after sending an unsolicited message via the "Contact Us" button on their homepage. This ended up being a wild, yet formative summer in which I lived out the tech startup fantasy in all its glory (and weirdness). That summer was spent building community online, standing up a verified artists program and hanging out with up-and-coming rappers. I went from pencil pushing to blunt rolling in the span of a year. All that to say, I'm not what you might consider an insurance guru nor an insurtech expert. But I did learn a thing or two along the way.

Today, we'll run through the history of risk management, the expertise accumulated over centuries and how technology is transforming every level of the "industry stack." Consider this a primer on Insurance, Technology and the French startups reclaiming the sector. If you're an actuarial wizkid, you can probably skip the reading and just follow Florian Graillot on Twitter, a VC at Astorya and all-around "Insurtech Guy."

Historical Claims

The concept of insurance, or more specifically spreading risk, has been around for millennia. You can trace it all the way back to ancient Babylonia and the Code of Hammurabi which is considered the oldest legal text which articulated rule of law under the 6th King of the 1st Dynasty. These rules ensured accountability, fairness and some level of risk management (although most consequences involve the death of one or more parties…) and were inscribed into a 7ft tall basalt stele. It just so happens to sit at the Louvre Museum here in Paris (as pictured in the cover image).

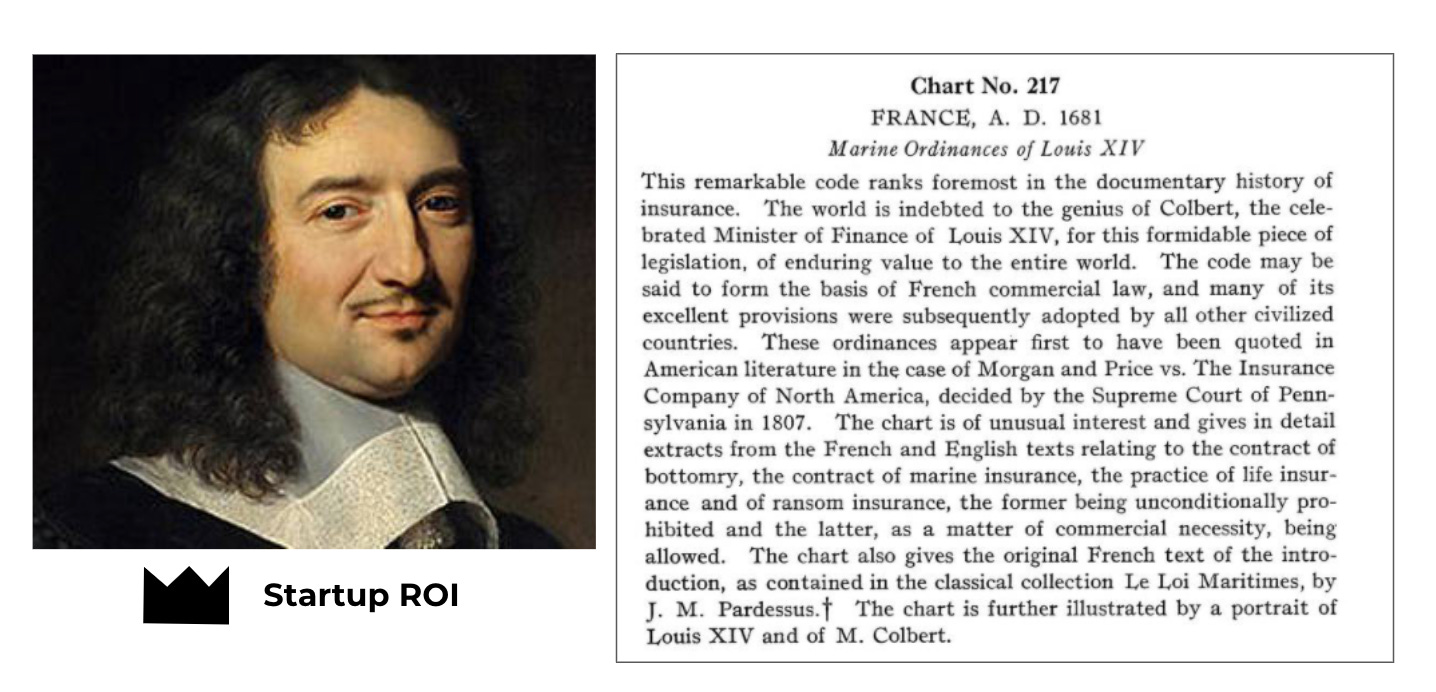

In the 17th Century, Jean-Baptiste Colbert, Chief Minister under King Louis XIV, introduced many modern concepts of insurance to the world through maritime commerce legislation.

Many subsequent innovations in the insurance industry have taken place since. Perhaps most notably was GEICO's omni-present ad campaign, high savings and ease of use. Owned by parent company Berkshire Hathaway, it's no wonder Warren Buffett was behind their transformation, an avid investor in (and lover of) the insurance industry. He's famously a fanatic for float a concept that is intrinsic to the business model we are about to explore.

Policy Wonks

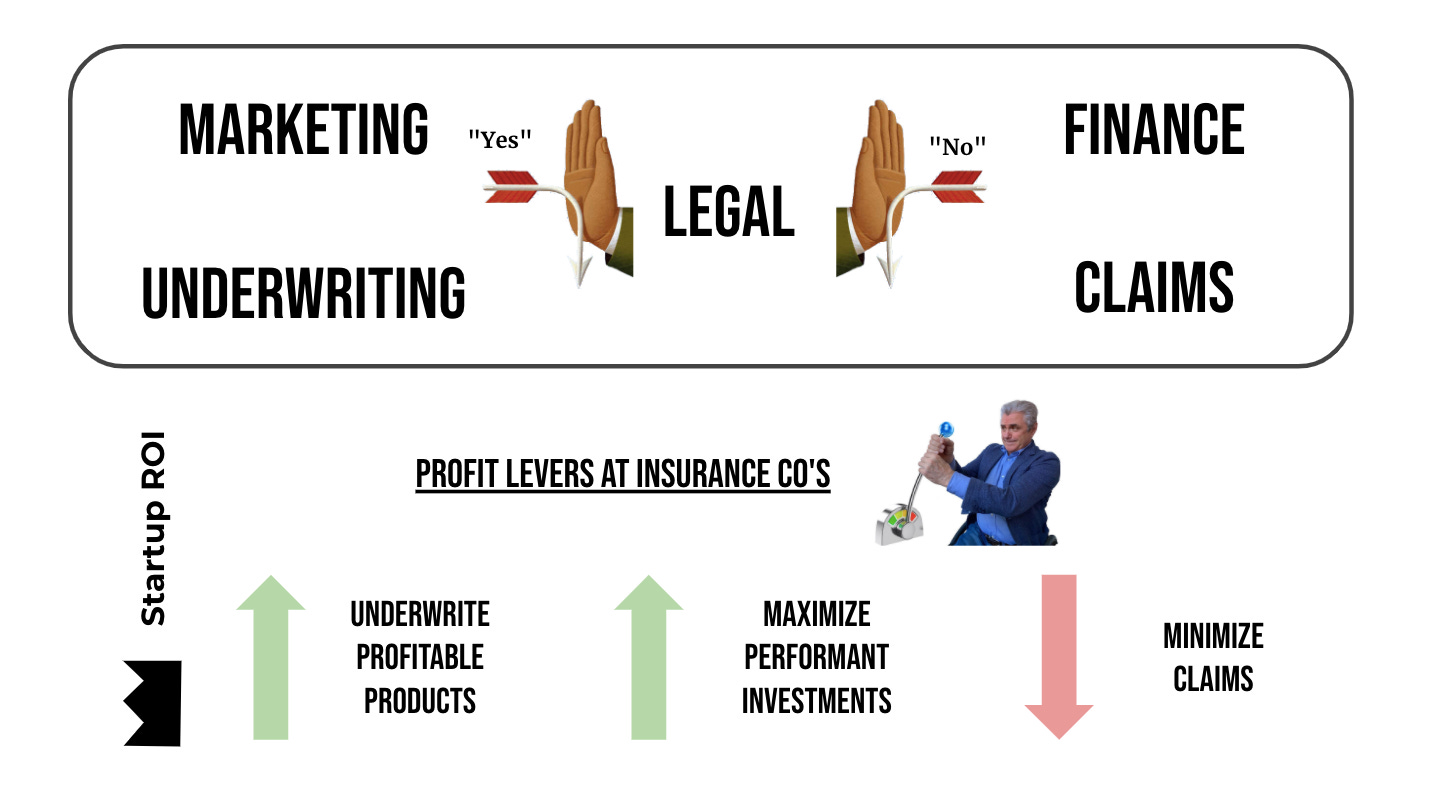

Finance, and its byproducts like insurance, are highly regulated industries. Which means there are functional differences across regions. But when it comes to the foundation of the insurance industry, the fundamentals are universal. An insurance company can be broken down into 5 departments: Marketing, Underwriting, Legal, Finance and Claims. To increase profitability, there are three main levers an insurance company can pull: improve underwriting, optimize investments, or reduce claims.

Let's break those down. The first two are offensive strategies, the final is defensive.

Underwriters are tasked with evaluating risk and developing insurance products that are profitable. Historically this meant creating actuarial tables (taking into account various data and risk factors) and creating contract terms that were compelling enough for a customer to purchase, but de-risked enough that payout terms were either favorable or statistically unlikely. Back in the day, this was an art and a science, although that's changing with the vast volume of data at our disposal today, as we'll see later.

Insurance companies make money by investing premiums in the market, so their Investment Team is basically taking zero interest loans from policyholders and allocating that capital to maximize returns.

Lastly, we've got Claims. Anyone who has made a claim knows that it can be a pain. Understandably, the insurance companies need to detect fraudulent claims to prevent unnecessary losses. But the department is structured as an obstacle between you and your payout.

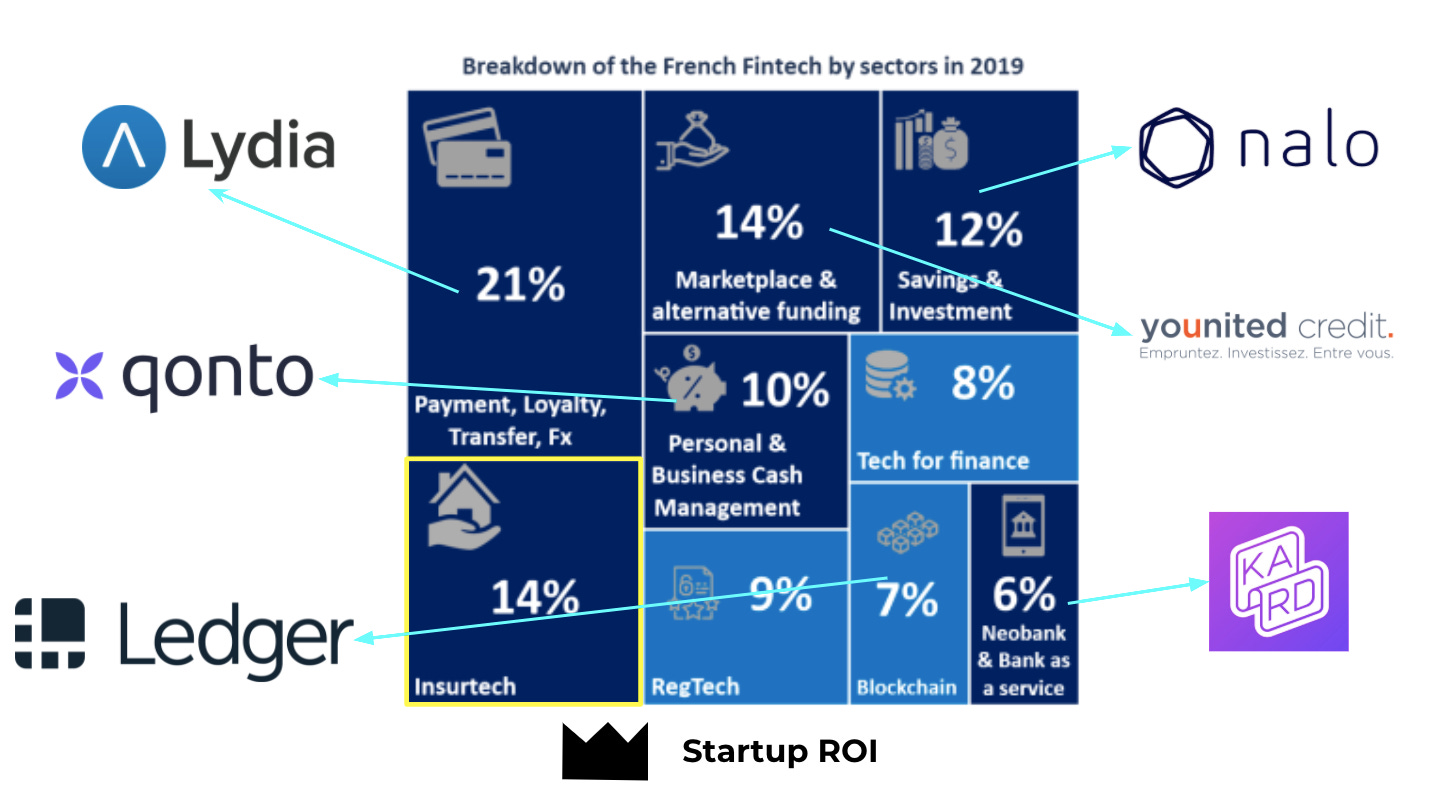

Brokers to Bots

Now that we've got the gist of it, let's look at the market dynamics that are exacting change. As we noted, insurance is a financial product and is linked to movements in the broader Financial Tech (Fintech) space. Insurtech accounts for about 14% of the broader Fintech category in France.

Within that category, there are several contenders varying in age, expertise, and sector.

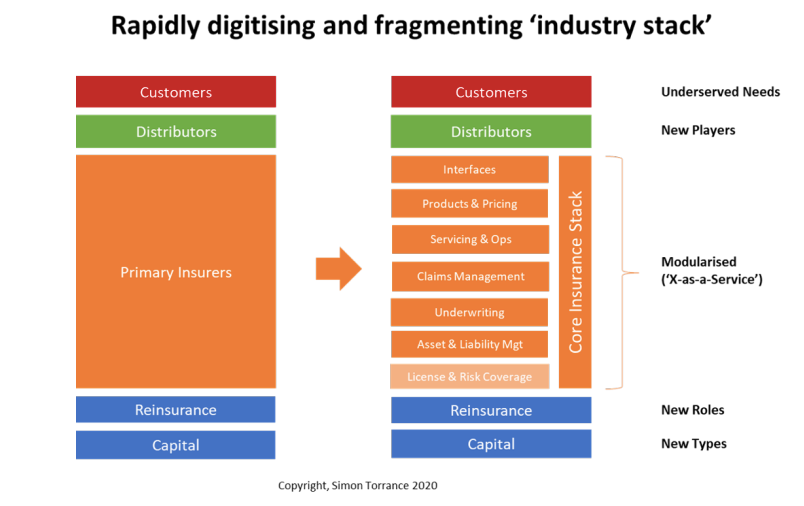

Technology has forced fragmentation within the primary insurance market, isolating single cases where they can deliver value. This graphic helpfully summarizes these categories:

And bundling all that together and presenting on-the-fly options for insurance policies is what is called Embedded Insurance. The trend towards embedded finance has shifted the relationship between policy makers, policyholders and the critical data used to formulate said policies. Today, an eCommerce site has more data about you, the potential buyer, than any actuarial team just a couple decades ago. Not only that, but the data is specific to you, not just statistical averages across a population. This radically changes the way customers find and purchase insurance (no longer taking cold calls from your friendly neighborhood life insurance salesman) and also transforms the kinds of underwriting that can be performed (in real-time and personalized). Here's a relatable example:

You are buying a plane ticket online

At checkout, you are prompted with the option to purchase cancellation insurance

The insurance is provided by a 3rd party (not the airline) and gives you a refund in the event of a last minute cancellation

The underwriting algorithm knows who you are, your age/sex/location, your purchase and credit history etc.

You can purchase a short-term policy with zero paperwork (and more importantly no interactions with an agent)

You have peace of mind in case of an unexpected emergency; the insurance company can invest premiums and ideally mitigate claims based on your profile and the additional data at their disposal

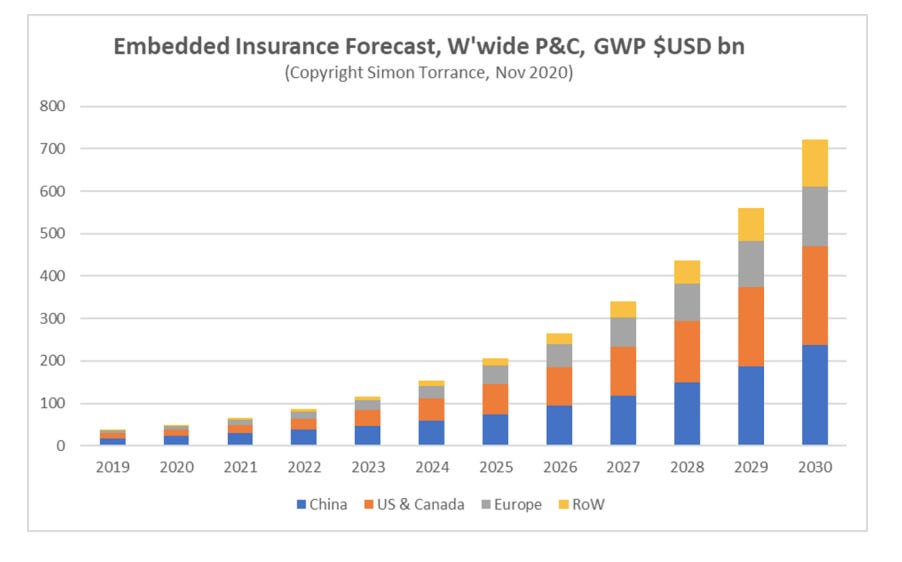

Seems nifty, right? But how transformational can this really be? The above example is child's play. You can build insurance products around just about anything and believe me, there are underwriters in some back room dreaming up policies we couldn't begin to imagine. Policies that would have been too risky or impossible to underwrite a decade ago are now within reach. And even better, distribution is at point of sale. These dynamics lead analysts to predict a $700B embedded insurance industry worldwide by 2030 (roughly $125B of that in Europe).

Risky Business: 3 Case Studies

Luko: The Digital Native

We've talked about bringing old business models to the digital sphere here, here and here. So this concept isn't new. But it's persistent. Luko is a home insurance provider that generates tailor-made, digital first policies for renters and homeowners alike. Having recently purchased an apartment, I actually just went through their intake process for a quote (instead of emailing back and forth with my faceless broker from the legacy insurance giant only to receive an endless Docusign contract with absolutely zero clarity or confidence in my coverage…). They offer instant reimbursement for claims, a step up from the bargaining process and paper pushing we're accustomed to (remember the three profit levers?). They make customizing a policy simple and flexible and offer transparency through their digital app. You might compare them to Alan, but for home instead of health insurance. Recently, they made the jump from Metro ads to full TV spots, so something must be going right! (or they're simply putting their €50M Series B to work).

Wakam: The Digital Transformation

When I researched this company I did a double take. Days later that is. At first, I was under the impression that Wakam was an IPaaS (Insurance Provider as a Service) startup. And they are. But then I learned that 5 years ago they did a re-brand (more like a reinvention), pivoting the company from a damage insurance provider to an embedded insurance, plug & play platform. Also impressive. But then I learned the original company was founded in 1829 (Les Parisiennes Assurances) and my head exploded.

This 200-year-old company overcame insurmountable corporate inertia not only to digitize their product and brand but to build a cutting-edge, B2B bespoke insurance toolkit. If you look up Digital Transformation in a French encyclopedia you should find their logo. HBS needs a case study on this turnaround. Before the rebrand, the technology pivot earned them a 2x increase in revenue from 2013-2015 (€53M - €108M). The proof was in the pudding and they never looked back. If you want to learn more, they have a great case study of their own featuring Matera, one of their proptech clients who I covered in a recent post titled Waiting for Haussman.

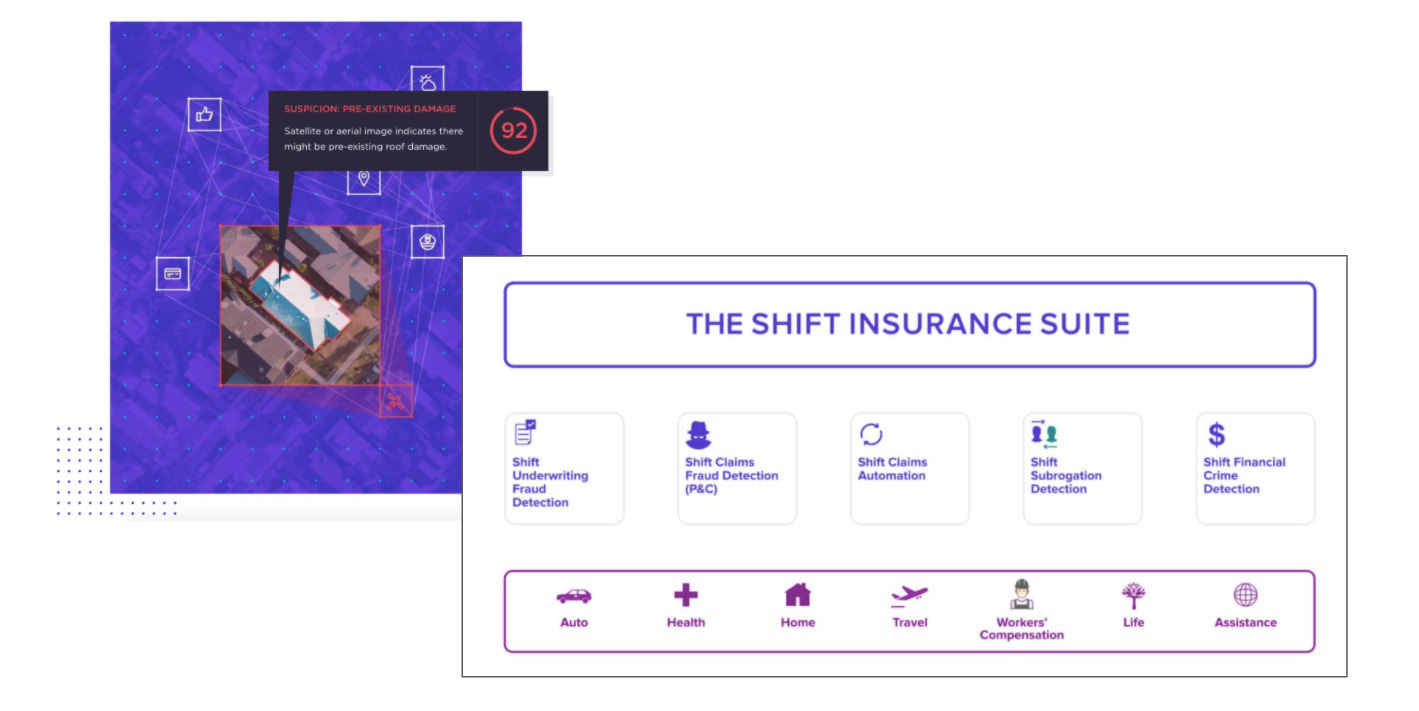

Shift: The Artificial Intelligence

These guys are the poster-child for French Insurtech. As an early unicorn and regularly referenced success story, it's easy to miss the forest through the trees. Shift is unlike the previous two cases because they aren't building insurance products nor are they enabling others to build them (OK, not completely true, their tool set influences how policies are structured, but indirectly so). They have tackled a completely different level of the "insurance stack": claims. Using artificial intelligence, they've built a powerful decision-making engine designed to detect fraud, automate the claims process and enhance customer experience simultaneously. Their solution extends across health, property & casualty as well as travel insurance which means they have a near unlimited customer base of B2B clients offering insurance products worldwide. Their platform has been used to analyze over 1.7B claims to date and they work with legacy providers (*cough, cough* : digital transformation) and new-age insurance providers alike.

Afterword: Just In Case

That's it for today. Thanks for reading! Below are some additional resources for interested parties:

Florian Graillot has a substack dedicated to #Insurtech

Mapping Fintech in France — Exton Consulting

Embedded Insurance — Simon Torrance via Rainmaking