Welcome to Startup ROI, where we explore global technology trends and how they manifest themselves in France 🇫🇷 . Whether you're an entrepreneur, investor or tech enthusiast, I'm glad to have you here! Quick announcements:

I did an #AMA with the Heyday community! Check it out here:

We've reached 150+ subscribers! Next stop: 500! Thanks for your support & readership. I hope this has been as fun, informative and exciting for you as it has been for me. Please continue to share what you find interesting with other like-minded tech enthusiasts.

And… if you haven't already, consider subscribing. It's free!

Introduction

I moved to Paris just under three years ago and for the sake of convenience, I started by renting a furnished apartment. After all, I wasn't sure how long I'd be here, so it didn't make sense to invest in a ton of furniture on day one. By the time I moved to my second apartment, I still wasn't sure what the future held, so I opted once again for a furnished studio. But for my latest move, I was finally ready to get settled and put down some roots or whatever people say… I should mention that I moved over 10 times as a kid, so I'm not very partial to (or sentimental about) any one location as a "home base." But as I approach the 3-year mark here in Paris, I can see a future (or at least a near-term future) where I stay put.

Last week my landlord came by to look into some minor electrical repairs when he broke some news. He was thinking about selling the place. I was caught completely off-guard. This was supposed to be my nest. Originally, he wanted a long-term tenant. He had owned the place for over 7 years and had even lived in it himself. He had valid reasons for listing it and I appreciated the transparency, but I couldn't help but feel betrayed. This was the third time I would have to move as a result of the owner selling their apartment. Inconvenient to say the least…

Shortly after he announced his intent to sell, he quickly mentioned that I had the right to first refusal as the current tenant and inquired whether or not I wanted to buy it. I wasn't sure I was ready for this type of investment. I had heard horror stories about real estate agents (agents immobilier), renovation projects (travaux) and property management co-ops (syndicats) — am I really prepared to make the jump to home ownership?

So I did what came naturally: I looked into local startups that could solve my dilemma. In this piece, I'll write about what I discovered in the French real estate market and the startups building products and services to help people like me. Perhaps together we can come to a conclusion as to whether or not I should buy this apartment (if it's even possible)!

iBuy, you buy, we buy!

FRICK-tion

Key Words / Mot Cles

Masteos: God of Real Estate

Smart House, Dumb Money

iBuy, you buy, we buy!

As I mentioned, I moved a lot as a kid. Fortunately, my childhood ignorance saved me the headache(s) associated with each transition. I mean, I had to meet new friends and adapt to new environments, but at least I didn't have to get a mortgage, understand ESCROW or host an inspection. In hindsight, I took a lot of it for granted (thanks Mom & Dad!). The reality is that buying a property is a big investment, with a ton of considerations. It's not as simple as throwing some cash into a mutual fund (my preferred investment strategy as discussed in The Infinite Learning Curve). And truthfully, some of the friction associated with buying a house is merited: there should be guardrails in place to ensure a positive outcome on all sides. However, that same friction (and in some cases flat out opacity) is what preserves outdated regulations, disincentivizes brokers, and unjustly discriminates against potential homebuyers. Property management is such a complex/messy business that it's one of the very last to be touched by the tech community. But that's changing dramatically. In an ideal world, tech will create efficiency, transparency and opportunity in an industry that is resting comfortably in all it's pre-internet glory.

There's a reason that owning your own home is inextricably linked to the success story we tell ourselves as a culture. It's a physical asset that (historically) gains value over time. You can live in it (try sleeping inside of a municipal bond…) and if you decide to live somewhere else, you can rent it out. There are tons of inherent advantages. The problem with owning property though, is that you have to take care of it. It can be a lot of work to maintain. Especially for our generation of Airbnb hopping, instant gratification, call-the-landlord-they'll-fix-it types. If a pipe bursts, you're on the hook. In addition, it's not nearly as liquid as other investments. I can't just cash out my house overnight if need be. There's a process for that (that we'll be getting into shortly). Lastly, it's hard to reconcile staying in one place for a long time with our remote-first, travel anywhere mindset. I guess what I'm saying is that our generation has commitment issues. These are some of the reasons I've been reluctant to invest in property. Despite this hesitancy, real estate is a massive market. In the US alone, residential real estate is a $1.6 TRILLION business. With a TAM like that, it's no surprise tech is after their share of the market. Let's look at some of the early pioneers.

The first wave followed a common approach we've seen in previous articles: take an existing marketplace and put it online. The quintessential example of this is Zillow (in the US) that built a comprehensive database of home prices with a compelling and easy-to-use interface: so much so that you've probably seen your Dad browsing home prices on his iPad without any intention of buying one. This was pretty revolutionary at the time and has become the default for early prospective buyers voyeuristically ogling their dream homes. But it's really just a window into the vast real estate value chain, a window that leaks quite a bit of that value to 3rd parties they connect you to (brokers, lenders etc.). The thing is, Zillow recognizes this seismic shift and has already implemented changes in their business model to move into the next phase. Their plan is to capture some of that leaked value by offering the services they currently direct users to through their application.

Which brings us to the next iteration of tech entering the real estate market. Unoriginally dubbed iBuying, the concept is fairly simple to explain (but quite hard to execute). In short, you buy houses on spec for a given price that you determine based on tons of data and analysis. For the seller, it saves you time, money and the headache of listing and showing your house. Plus, it's guaranteed liquidity ASAP. For the iBuyer, you make a margin on paying cash at a discount and handling all of the other aspects of buying a home at scale (one-stop-shop for inspection, staging, showing, re-selling). The leader on this front is undoubtedly Opendoor, who recently went public via a very splashy SPAC spearheaded by Chamath Palihapitiya.

So we've got two approaches thus far. The marketplace model served as an internet on-ramp for real estate. iBuying consolidates the painful process of putting your house up for sale by condensing the steps, handling logistics and making algorithmic pricing & purchasing decisions at scale. But with a big market, a multi-stage process, and regional regulatory variance, there are some other playbooks here worth exploring. For this, we turn to my current predicament and the French real estate market.

FRICK-tion

We've established that buying a house can be a painful process. Multiply that by a factor of 10 when you're living in a foreign country. Not only are the standard processes more complicated (getting a mortgage, negotiating with agents, getting quotes from contractors) but there are cultural and structural differences that exacerbate the friction we so dearly want to eliminate. I've done my fair share of bashing unnecessary French bureaucracy in previous posts, but there are a handful of references worth mentioning with respect to real estate.

The first is a notaire, the most notorious of public functionaries in France. It's required by law that they sign over the deed to your new home and both sides have to pay them in order to do so. You can't avoid it and it will cost you anywhere from 4-8% of the selling price of the property.

Next is the Syndicat de Copropriété (or simply syndic). It's a bit like a home owners association and makes decisions on a variety of building related matters. For example, voting on whether or not you can do a renovation and if you'll have to compensate the tenants. The Syndic is required to take regular training to stay up to date on regulations, but in Paris, at least, they are fairly well known for running mob-style schemes and extorting tenants (*slight exaggeration).

The Emprunt Immobilier, or mortgage, is a key step in the process. The amount you can borrow depends on a number of factors including your income, savings and the amount you put towards the property upfront. There are even people with the job title "courtier" who help you find the best possible mortgage for your situation. Down payments tend to be lower in France than in the US, averaging around 10%. They are pretty strict on the math here (they tend to be weary of credit in general). Even when renting, for example, it's forbidden to rent a place that's more than ⅓ of your monthly salary meaning if you make €3K/month pre-tax, you'll have to find an apartment whose rent is €1K or below.

And lastly, is Travaux. This roughly translates to renovation/construction and is a pain in the ass here as it is anywhere. If you recall previous diatribes on French holiday policy and the 35-hour work week, you can probably infer that getting a project done well and on time is a rarity.

Enough definitions. Let's look at the real estate value chain and examine a few of the companies looking to disrupt the traditional approach to home buying in France.

Part of the reason there's so much friction in real estate is because each step of the process requires a degree of specialization. If you think about it, homes are quite a complex financial instrument with both physical and abstract value. Plus, each of the stages above correlates to a different core skill set:

Search Marketplace : Digital/Database/Tech

Mortgage : Banking/Finance

Furnishing : Design

Agents & Brokers : Rules, Regulations and Domain Expertise

Renovation : Construction, Architecture, Artisanship

Property Management : Rental Market, Taxes, Maintenance

It's no wonder that the checklist from browse to buy is so long and drawn out…

When going after a new market in tech, a logical place to start is finding inefficiencies and solving them. Walking through the buyer journey it's clear that there are several points of entry. After solving one problem, it makes sense to expand into an adjacent one, ideally a sequential step in the larger process. Lastly, if you're ambitious, you'd aim to create an end-to-end solution. We already see this happening which causes the process steps to blur. Zillow did this by migrating from a listings site to offering mortgages and property management tools. Opendoor essentially rolls all phases into one and has developed a one-stop-shop liquidity market for real estate.

Let's dive deeper into the French tech companies exploring efficiency gains in their respective buying journey verticals.

Key Words / Mot Clés

Search Marketplace

On the surface, Flatlooker is a rental property marketplace. But their real customers are actually homeowners themselves. Their goal is to make rentals and property management as easy and seamless as possible, which includes digitizing a large portion of the process. In France, for example, it's typically mandatory to put together a "dossier" (think of it like a resume for your real estate agent) to prove you meet requirements. In high-demand cities like Paris, you might see a line of people at a showing waiting to drop these applications off at the door. What's even crazier, is that it's not uncommon to see people bring paper copies. Passport, payslips, tax forms, utility bills — the tab at your local print shop might cost you more than your security deposit!

Bienici serves a similar purpose but specifically for purchases. They've positioned themselves as a thought leader with tons of content covering the ins and outs of home ownership, incentives behind owning to live vs. owning as a landlord, and general best practices on the French real estate market. Similar to an early Zillow, they offer a database & map view for finding rentals based on your search parameters and then relay you to a 3rd party realtor to initiate the process if you're interested.

Both approaches are what I consider tech-enabled traditional real estate. They've simplified the search process and increased conversion of prospective buyers for the real estate agencies. In addition, they've widened the playing field (you can see any listing, not just the ones your agent shows you). This is certainly helpful and introduces efficiencies to the process, but doesn't transform the process in and of itself. That said, they are well positioned to extend services beyond discovery by creating an in-house agency or lending group.

Mortgage & Finance

Borrowing money is usually associated with big milestones. Going to university, for example, or launching a new business venture. The same is true for buying property. But since it's not something you do on a regular basis, the process (and pricing) can be somewhat opaque. Mortgages (home loans) are different from your regular, everyday loan because (1) there is collateral in the event of default — the house and (2) they are paid out over a long time horizon, acceptable because there isn't a record of houses fleeing the state. But understanding how much you can afford or what a good interest rate might be is still a bit murky. That's where Pretto comes into play.

Earlier, we talked about a courtier — someone whose job is to find you the best mortgage rates based on your situation. Pretto is working to digitize that role, making it accessible to anyone with an internet connection. Simply fill in some personal details and find yourself a mortgage. For now, they are essentially a lead generation tool for banks looking to make loans. But, with the amount of data they are collecting, it wouldn't surprise me if they captured value down the buyer journey and made their own lending product as well.

Agents & Brokers

In this category, Liberkeys and Proprioo have a similar strategy: make real estate agents better. For my American audience, this might not seem very imaginative. American culture puts a premium on service that isn't emphasized quite so strongly here. But even more bizarre, is the fact that historically, realtors only worked for the sellers, not the buyers. With high demand, they could basically just kick back and wait for the best offer to optimize their commission which was frustrating for buyers and lacked visibility for sellers (who likely needed cash for their next project). In short, these two startups are re-aligning incentives, reducing costs, and tying commission structure to closing. Turns out providing a little transparency in an industry designed to be opaque has a major impact on customer satisfaction.

Property Management

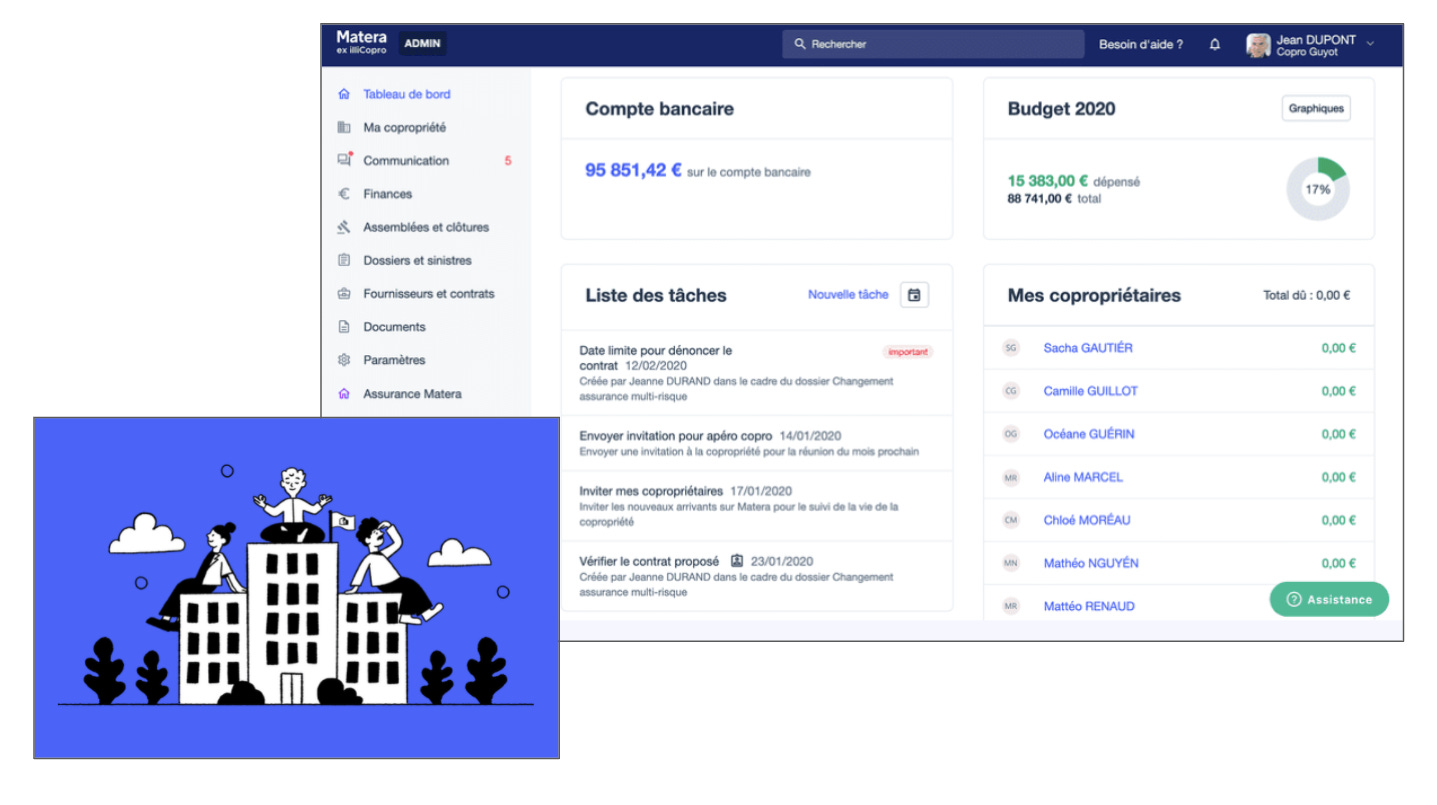

When you think of enterprise software, the first thing that comes to mind is usually big business. But in a world that's being eaten by software, enterprise-grade tooling is available to just about anyone, in any profession. Which is why highly specialized SaaS products have become hugely popular categories as of late. Unlatch, for example, provides Customer Relationship Management (CRM) software for real estate. And Matera, was built to bring clarity and communication to co-ops — a famously elusive organization. Reporting leaks or property damage, direct messaging neighbors, finding specialists to fix something and reporting budget in real-time. It's like Nextdoor, Angies List, and a Tableau had a baby.

If we think of the property tech transformation as a spectrum, the innovation taking place in France fits squarely in Stage 2 (as depicted below): identifying a stage of the buyer journey and improving it with software tools. As far as I can tell, iBuying hasn't taken hold in the French market; however, there is one nascent startup that is approaching this model with a twist.

Masteos: God of Real Estate

Real estate is the most preferred investment vehicle in France. According to L'Insee (Nation Institute of Statistics and Economic Studies), 7.6% of French households own at least one rental property. On paper, it seems easy enough: buy a property, rent it out, and move in or sell it down the line when I need the cash. But as we discussed, it's really a multi-stage process that can prove to be a burden on your mental health. This is where Masteos sees opportunity.

They've fused together two playbooks: make one step of the buyer journey significantly better & use data and analytics for smart purchasing decisions (iBuying). They aren't buying homes on the spot, however they are conducting the research and providing recommendations to prospective investors. Once an investor (i.e. future landlord) buys the property, they offer a suite of products and services to make you a property wiz. They offer help with each step after the buying process (potentially more daunting than actually signing the contract): renovation, furnishing and general management.

The barriers to entry in home buying are high such that each phase that can be simplified or flat out handled externally drives a potential buyer one step closer to execution. Which is why I find this company particularly compelling as a front-runner in the next wave of prop tech companies to come out of France. They are incredibly early stage, having only raised a €1.1M angel round. But among those investors are a few names that give a big endorsement including both the founder of Onefinestay and Meero. I'll be following along closely and should my apartment purchase fall through, it's likely I'll be spending my free time browsing their listings.

Smart House, Dumb Money

This current phase in property tech is exciting. It's clear there's plenty of runway for continued digitization and disruption to the way we buy, sell, rent and borrow for homes. Consumer expectations have shifted to instant, mobile-first exchanges and that expectation continues to climb the value chain. The ease with which we buy a coffee in the morning needs to apply to larger and more complex transactions. And we are starting to see that happen.

But to close with a thought exercise, I wanted to think about a logical extension of these principles. Where do we go from here? What does the home buying experience look like in 20 years? In a previous article, we explored the emerging metaverse, a fusion of our physical and digital realities. Which begs the question: will we even care about owning a home in a future where we can world-build in virtual reality? In our lifetime, I'd say yes. So where exactly is the next frontier? What happens after we digitize each step in the process, provide liquidity such that a transaction is cut down from 3 months to 3 days, wrap lending/furnishing/renovation into a single mobile experience? My prediction: blockchain-powered Real-Estate-as-a-Service.

In our brave new remote-first world, I'm betting we'll put a premium on liquidity (move in and out easily) and features (furnishings, connected tech, amenities). Imagine a home either built from scratch or retro-fitted to track everything from the person who is staying there at the moment (locks enabled with a mobile identity solution), to utility usage (charge tenants for electricity/water during their stay), to routines (automate heat/AC, lights and connected speakers). What sounds like Airbnb on steroids could actually translate into ownership, fractionalized ownership that is, via tokenization. Instead of owning one home, you could own fractions of multiple homes and stay when you want (when it's available) and apply profits from rent towards other stays around the world. Accountability, insurance, and scheduling could all be managed through an interface built on the blockchain.

Maybe I'm onto something… or maybe I just watched Disney's Smart House one too many times as a kid.

Thanks for reading! Send your feedback and for the love of Haussmann, if you have any real estate expertise please send your advice.

Bonus: some required reading for anyone looking to invest in French real estate ⤵️

The “one-stop-shop” ➡️ Click Here

🐦 Twitter: @StartupROI & @RoiStartup 🧐 choose wisely

👔 LinkedIn: Startup ROI

📸 Instagram: @startuproi

🎁 Feedback is a gift — 📩 bonjour@startup-roi.com

I think the best way to find an apartment in Paris is to go through small business agency like Actea (www.actea-conseil.fr) as they have a more personalised service and are keen to meet your requirements fast