🦆 Cornering the Market(place)

The Unbundling of Le Bon Coin & The Future of Digital Marketplaces

Hi everyone! Welcome to article #3

As the saying goes, if you have to explain the joke, it's probably not funny. But I swear to you, the below graphic is an exception to the rule. I'm providing a translation guide to ensure a hearty chuckle to both my French and American audience ⤵️

French ducks say “Coin, coin!” (for pronunciation, see this video) not “Quack, quack!”

Le coin in French translates to the corner in English

Today, we are discussing Le Bon Coin (see, this joke works on so many levels!) and the evolution of digital marketplaces.

One of the great pleasures of living in Paris is going to the market. In the US, we're accustomed to the "one-stop-shop" convenience of large grocery chains. These exist in France, too, but there's an appreciation for the specialty shops that enable them to survive (and thrive) at a level that you just don't see back home. Looking for a quality baguette? Head to the boulangerie. How about some fish? Your poissonière will recount the story of this salmon's birth before you take it home for dinner. There's something about having an expert in front of you that turns an ordinary shopping experience into a hidden secret. These artisans make up a quintessential Parisian experience.

When I first arrived, I thought, how do these little markets survive? They've got to compete with the big box stores around the corner with better prices. But there tends to be a trade-off between convenience and quality. Digital storefronts followed much the same pattern: selling strictly books, for example, before expanding into the online everything store. Thanks to the internet, markets can be made instantly, goods and services can be transacted without exchanging physical money (or even meeting the person rendering the goods/services!), and as the playing field evens out, new "specialty markets" of the internet have emerged.

Today, we'll explore the evolution of the "digital marketplace model" in France and the "good corner" of the internet that spawned a movement.

Le Bon Coin

The Unbundling

Finding Your Edge in the Digital Marketplace

A Case Study: Malt vs Meero

The Future of Marketplaces

After Market Musings

Le Bon Coin

The term "marketplace" gets thrown around quite often in the technology industry, especially as software improvements enable more and more complexity in market-making. Put simply, a market requires a buyer, a seller, and a market-maker to facilitate a transaction. Software naturally emerged as an elegant market-making interface. In its most basic form: a listings site. For my American readers, you'll probably be most familiar with Craigslist which became a household name in equal parts for it's brilliance and sketchiness. The site still functions today although I'm not sure it's had a design update since the late 90s!

The French analog to Craigslist is Le Bon Coin, a listings site launched in 2006. These sites became the "town squares" of the internet, where practically anyone with a computer could market their wares or pitch their services. Despite becoming wildly popular, these sites encountered several problems, mainly due to the internet's lack of maturity during this era. Issues ranged from monetization (Stripe didn't exist yet!) to safety (how to control for quality & verify identities among vendors and shoppers) to discovery (targeted content wasn't quite like it is today). Nevertheless, they grew and began to solve some of these challenges along the way.

Le Bon Coin has done exceptionally well over the years. It's consistently ranked among the top 5 sites in France (127th globally) and attracts 30 million unique visitors per month (France's population sits around 67 million). Perhaps its popularity can be attributed to the fact that it's free to post and browse on the site. Their revenue is purely ad-based: serving up independent advertisements and enabling vendors to sponsor post visibility (pay a premium to cut through the noise). In short, Le Bon Coin had first-mover advantage, developed a premium brand name as France's leading classifieds site, and regularly expanded their offering (focused on localization, added new verticals, launched a mobile app). They are such a staple of French internet culture that the president wished them a Happy 15th birthday on LinkedIn, touting them as champions of the circular economy.

But all of these aforementioned advantages have a counterweight. First to market means an older, less agile technology stack. The sheer scale and variety of their marketplace makes it difficult for them to specialize and deliver a differentiated customer experience. Plus, in a world where internet consumers are immune to ads and curation outpaces capacity, newer, more specialized market-makers have entered the race.

The Unbundling

Classified sites like Le Bon Coin set the tone for early internet transactions. Their clearest advantage, however, also proved to be a weakness. Internet consumers in this era would reflexively go to a site like Le Bon Coin to check out local listings, maybe even do a price comparison, but points of friction made it difficult to convert "lurkers" into customers. The site had tons of energy, it just happened to be unusable. Something in physics called entropy. Entropy Theory (a term coined by Packy M of Not Boring) explains that the ever-increasing chaos in a market presents an opportunity for those using the latest technology to "wrangle the entropy" and unlock value previously lost in the chaos. The listing categories section on Le Bon Coin is virtually a heat map of value leakage that, if properly captured, could justify an entirely new business. If you look at the next generation of marketplace businesses in France, you can practically map them to the various categories highlighted on Le Bon Coin's homepage.

Each one of these startups saw an opportunity to capitalize via specialization. Coming back to my earlier analogy, Le Bon Coin had become the giant grocer (Monoprix) and consumer behavior was pivoting to the personalized and highly curated (like a 20 minute conversation at the Fromagier [cheese guy] about the origin of the goat who produced this batch's milk).

Here's a sampling of the French startups above that have taken this playbook to heart:

Instead of recreating a job board, Welcome to the Jungle built features to highlight company values, quickly and easily send resumes and candidate profiles, and power a streamlined application tracking system for employers.

Taking a cross-country road-trip can be exhausting with friends and family, let alone a stranger. Which is why BlaBlaCar introduced a "Bla'' score for their ride-sharing marketplace to indicate how much talking you might expect from your co-pilot. Not to mention solutions for in-app payments, scheduling, identity verification etc.

BackMarket was fundamentally aligned with the idea of the "circular economy" but less convinced about verifying the quality of refurbished electronics. So they built a multi-sided marketplace where they can validate vendors, issue scores/ratings and ensure quick and efficient delivery.

Thrift shopping requires skill: hunting for that vintage diamond in the rough takes time. Imagine parsing through millions of listings with shoddy camera work and varying levels of taste… Vestiaire Collective reinvented the online 2nd hand shopping experience with curated collections, influencer sellers, and easy search and filtering capabilities, all within their sleek mobile app.

I can't say that each of these companies scoured sites like Le Bon Coin in search of a vertical to go after. But one pioneer of the modern marketplace (quite famously) did exactly that. In its early days, Airbnb was having trouble gaining traction. Before establishing themselves as a travel behemoth, they struggled to get people to book through the app at all. But they did know one location where people were, at the very least, looking at listings: Craigslist. In this textbook "growth hack" the team was able to siphon some of the value leakage inherent to Craigslist: ideal for discovery but weak for conversion. They built a script to port each new host listing on AirBnB to Craigslist rentals, the link inside the post redirected them to Airbnb's site for booking.

Your first instinct might be to go straight to your favorite listings site, find a category without any major competitor and build your own marketplace from scratch. It's much easier said than done. Next, we'll take a look at marketplace dynamics, the rules that govern them, and evaluate just how much marketplace businesses have expanded in the past two decades.

Finding Your Edge in the Digital Marketplace

The era of unbundling has opened the door to a lot of important questions:

How do digital marketplaces function?

What qualities give comparative advantage to one over another?

Which technologies have introduced new use-cases or opened up previously unavailable markets?

Bill Gurley, General Partner at Benchmark Capital (investors in eBay, Yelp, Zillow & Grubhub among others), is confident he has the answers. He wrote a piece back in 2011 called "All Markets Are Not Created Equal," in which he lays out 10 rules of thumb when evaluating a digital marketplace business. For the sake of brevity, I've adapted a few of his rules into key categories and will break them down below.

Customer Delight

New Experience > the Status Quo: Entering a space requires some real innovation. You can't copy & paste the "Services" subsection and aggregate listings in hopes that customers will adopt your tool over the existing one. The user experience needs to be differentiated and enhanced. For example, with WeCasa (service scheduling marketplace ranging from home cleaning to haircuts), I was able to avoid back & forth emails with a listing agent thanks to their mobile app, intake questions and peer reviewed staff.

Value Added Tech: Breakthroughs in broadband, connected devices, and geo-tracking improve the experience for all market stakeholders. Sure, it's nice I can see my delivery driver in real-time on my phone, but predictive analytics, route optimization, order updates and logistics are all working in the background to ensure the core product: my item gets from point A to point B on time.

Integrated Payments: It wasn't always as easy as adding a line of code to your app to fully integrate a payment gateway. We take it for granted now, but payment reconciliation, especially with multiple stakeholders, can be slow and painful. With the advent of tools like Stripe, the vendor can get paid out instantly, the platform can automatically deduct their take rate, and the customer doesn't sit around waiting for an invoice they have to follow-up on. This may be the single most important development to reduce friction and improve liquidity.

The Burden of Choice & Beauty of Convenience

High Fragmentation: This pertains to both the buyer and seller side of the marketplace. High fragmentation necessitates an intermediary with whom other parties are willing to share the economics if the platform can provide liquidity in the market.

Frequency: How often do users interact with the marketplace? A one-and-done relationship is less powerful than a long-term, monogamous one. Even better if you can become like a utility to your customers. This is usually cemented once your brand has become a verb (Let's Uber there! or Can we Deliveroo tonight?).

Supply & Demand: The Chicken or the Egg?

Frictionless Supplier Sign-Up: You need adequate supply if you're planning to sell a good or service. In an asset-light marketplace, maybe it's as simple as a straight-forward registration form (or even better, single/social sign-on); but for asset heavy businesses it's critical to get a launch process in place and replicate each time you open a new market to onboard additional vendors.

Network Effects: This phenomenon describes a scenario in which each additional user in the marketplace adds incremental value to preceding users. The expression "when the tide comes in, all boats rise," comes to mind. More users means more potential sales for the suppliers. More suppliers means more customer choice. More of both means better user data and higher revenue for the platform. Win-win-win! It should be noted this is rare but highly encouraged to be exploited if at all present!

A Case Study: Malt vs Meero

Let's try and put it all together with a quick case-study comparing two incredibly successful upstarts in France leveraging the marketplace model in slightly different ways. Malt is a freelance marketplace connecting businesses to specialists across disciplines (developers, designers, you name it) to outsource projects. Meero, much in the same way, connects businesses with professionals, but they specialize exclusively in photography. I have first-hand experience with both organizations — with Malt as a "user" and with Meero as a consultant on their B2B community building efforts.

I used Malt to find a translator for a project I was overseeing at a previous startup. I was able to identify candidates fairly quickly using their powerful search and filtering capabilities and then narrow down the ideal fit by reading reviews and samples of their work. Initiating a chat within the app made it quick to get a sense for their personality and connect via video call to confirm we were aligned on project goals. Later on, I asked the freelancer why Malt? Why not just use the platform for lead generation and coordinate payments outside of the system? According to her, Malt handles all of the payment processing and even issues her documentation for tax purposes. This is a perfect example of a product-oriented differentiator that enhances "stickiness" for the users. With value-added technology Malt is able to reduce "leakage," improve experience for both parties, and keep users on the platform, thus powering the underlying network effects that lead to spectacular growth.

In Meero's case, deep specialization offers advantages but also demands curation, quality control, and a superior experience for all sides of the marketplace. Where Malt built a product to "wrangle the entropy" in a highly fragmented market, Meero is building a community around their core technology (artificially intelligent photo-editing software) and using it to benefit both parties: freelance photographers and businesses in need of high-quality images for their website or marketing materials. While the tech stands out as highly differentiated, the complexity (think about frictionless supplier sign-up and management) creates challenges: educating stakeholders on the value proposition, engaging the community, and business development strategies. This approach — the “managed marketplace” — is considered more "asset heavy" (more people, process & technology to support it) but due to its unique selling point it commands a higher take rate which leads to higher revenues if executed properly.

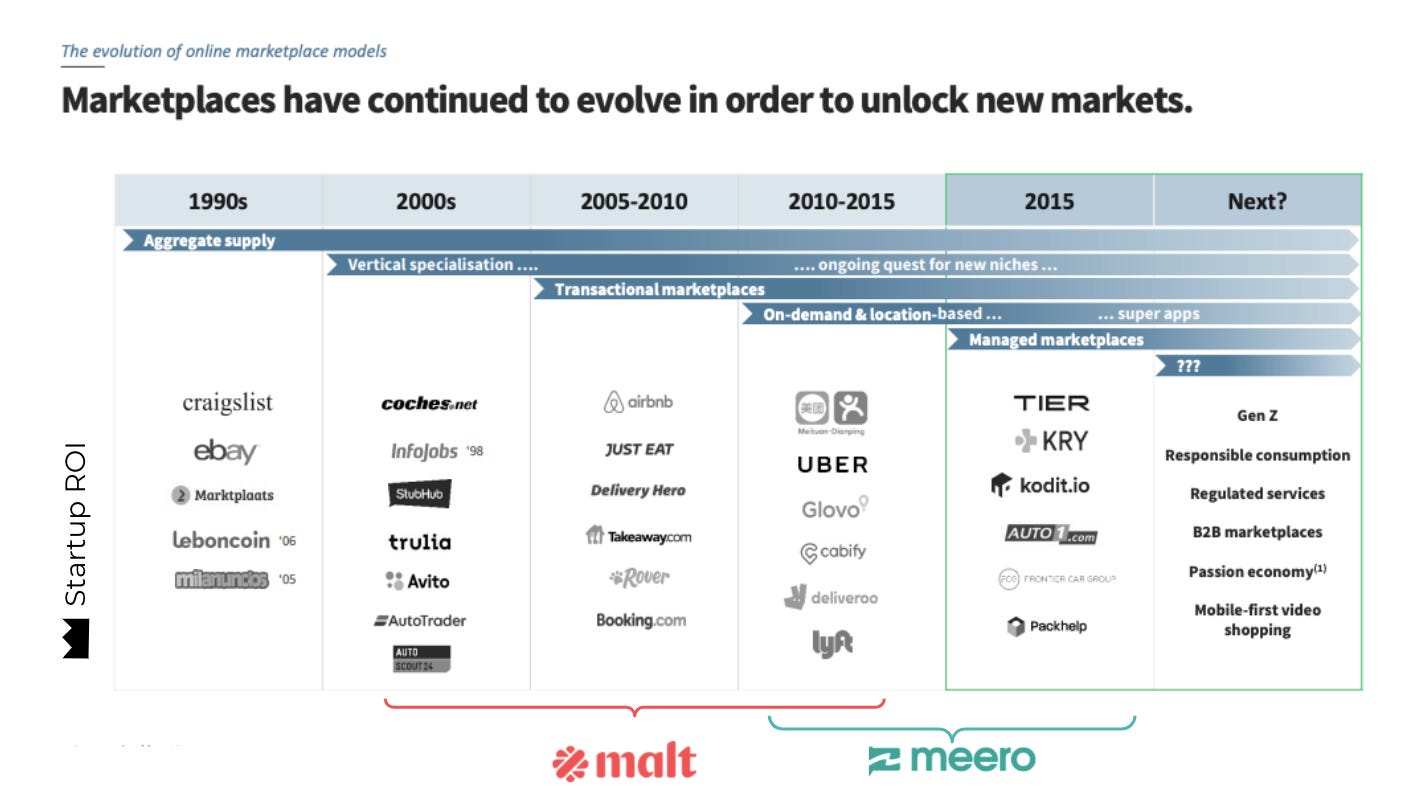

Neither approach is necessarily better than the other. They just present new opportunities and challenges by bringing stakeholders together in different ways. In the graphic above, you'll see I categorize Malt in the transactional/on-demand/location-based model whereas Meero straddles location-based/managed marketplaces. If you follow the money, it's clear that the investment community is slightly more bullish on Meero's model than Malt's. Nevertheless, there are new marketplace models yet to be invented that might unlock even more value.

The Future of Marketplaces

There is plenty of speculation about the future to go around, so I'll keep this brief. If you've taken away anything from this piece, it's likely that the term marketplace has a somewhat flexible definition. Emerging actors will continue to push the boundaries and I look forward to seeing the results. Here are a few predictions on categories ripe for disruption including some innovators leading the charge:

Data & AI Services : Namr is a fascinating #FrenchTech startup combining big data & AI to turn information overload into actionable insights around climate (I wrote a detailed Twitter thread on their work a while back).

Healthcare (Mental Health) : I wrote about Alan a couple weeks ago who is in the process of re-inventing health insurance markets across Europe. I assume other highly regulated industries will be prone to change as well. I also recently discovered Teale, which is focusing on mental health at work (would love to write about their efforts!)

Education/Accreditation : Open Classrooms is a #FrenchTech protégé looking to re-architect how we learn and attribute knowledge to individuals.

Curation-as-a-Service : This term is borrowed from my Twitter friend Andrea Hernandez who is single-handedly curating the explosion of functional food and beverage brands worldwide via The Snaxshot. I believe there is opportunity to do this (manually & via tech-enabled platforms) in other industries where the volume of data makes for high fragmentation, lack of trust & slow decision-making.

After Market Musings

Just as there is room for major grocery chains and your favorite caviste (wine seller) there will be space for a variety of marketplace models. While VCs chase the shiniest new object on the scene, others will be perfecting and improving upon the stakeholder experience in their corner of the market.

For more on this subject, here is some recommended reading:

All Markets Are Not Created Equal: 10 Factors To Consider When Evaluating Digital Marketplaces via Above the Crowd by Bill Gurley

Online Marketplaces Entering the Next Phases via Adevinta & Dealroom

What's Next for Marketplace Startups? via a16z Blog

A Guide to Marketplaces, 2nd Edition by Angela Tran Kingyens & Boris Wertz

I hope you're enjoying my weekly newsletter. If you are, consider sharing it with a friend or following me on social for more frequent updates!

The “one-stop-shop” ➡️ Click Here

🐦 Twitter: @StartupROI & @RoiStartup 🧐 choose wisely

👔 LinkedIn: Startup ROI

📸 Instagram: @startuproi

🎁 Feedback is a gift — 📩 bonjour@startup-roi.com