Predicting the next $100B vertically-integrated startup (e.g. Tesla, Apple)

3 signals investors and founders look for when predicting the next vertically integrated startup

The rise of vertically integrated startups

In the startup world, there is an emerging narrative that the biggest companies in the next decade will not be SaaS, AI or enterprise software, but vertically-integrated startups.

These were the Standard Oil, Ford, AT&T, General Electric of the past generation

These are the SpaceX, Tesla, Apple & Nvidia, TSMC’s of the current generation

These will be the Redwood Materials, Anduril, Gingko Bioworks of the next generation

But how does the normal person build such a startup? Is this possible?

Why this essay

I’m a YC founder, who just finished his 1st company.

I’m also a former Uber alum (ML engineer for self-driving cars).

My long term goal is to build my own meaningful vertically-integrated startup and invest in these types of companies. As I begin the journey of figuring out the 2nd company, I realized there’s surprisingly little practical guidance on how to identify and build such companies.

Hence, this essay was born out of a desire to answer 2 questions.

What signals foreshadow the rise of a vertical integrator?

How can founders and investors identify these signals early and use them to build and invest in their own vertically integrated startups?

What is a vertically integrated startup?

Although there’s no precise definition of a vertically-integrated startup, but they all share a few common characteristics

They build physical products

They excel at both hardware and software

They require high-upfront capital and are unlikely to be bootstrapped

They have long R&D cycles before revenue

Here’s how some prominent VCs have defined vertically-interated startups.

Peter Thiel cites Standard Oil, General Electric as examples of a vertically-integrated startups from the 2nd industrial revolution. The innovation was not the product, but how these companies vertically integrated their supply chains to deliver products that are 10x cheaper.

Packy McCormick refers to these startups as vertical integrators

Ian Cantos refers to vertically-integrated startups as full-stack deeptech. In my opinion, he has the best definition of vertically integrated startups (see quote below)

What conditions create a vertically-integrated startup?

The next Tesla or Anduril won't announce itself. Instead, it will emerge quietly at the intersection of new technologies and unmet market needs. The challenge for investors and founders is anticipating those changes before they happen.

The relevant question to ask is

What are the necessary conditions that hint at the emergence of a vertical integrator?

My working theory is that these startups emerge based on 3 leading indicators

Exponential indicator: fast improvement of existing physics or engineering capabilities

Off-path indicator: a metric that implies an overlooked, likely solvable problem

Ground zero indicator : an environment where incumbents cannot compete easily

Signal 1 : Exponential trends

Like all startups, vertical integrators also have to answer the “why now” question. The timing of a vertical integrator often aligns with an exponential improvement in existing engineering or physics capabilities.

Example: Amazon and the Internet Boom

Jeff Bezos attributed the founding of Amazon to internet growth

“I came across the fact that the World Wide Web was growing at 2300%. Anything growing that fast even if its baseline usage is tiny , its growing so fast that it's going to be big”

If we take our time-machine and go back to 1994 and take the assumption of internet growth to be true, the emergence of some massive e-commerce business seems almost inevitable. The contrarian insight was not about the inevitability of e-commerce. Rather the unique insight was the unique leverage starting with books would have.

Example: Tesla and Lithium-Ion batteries

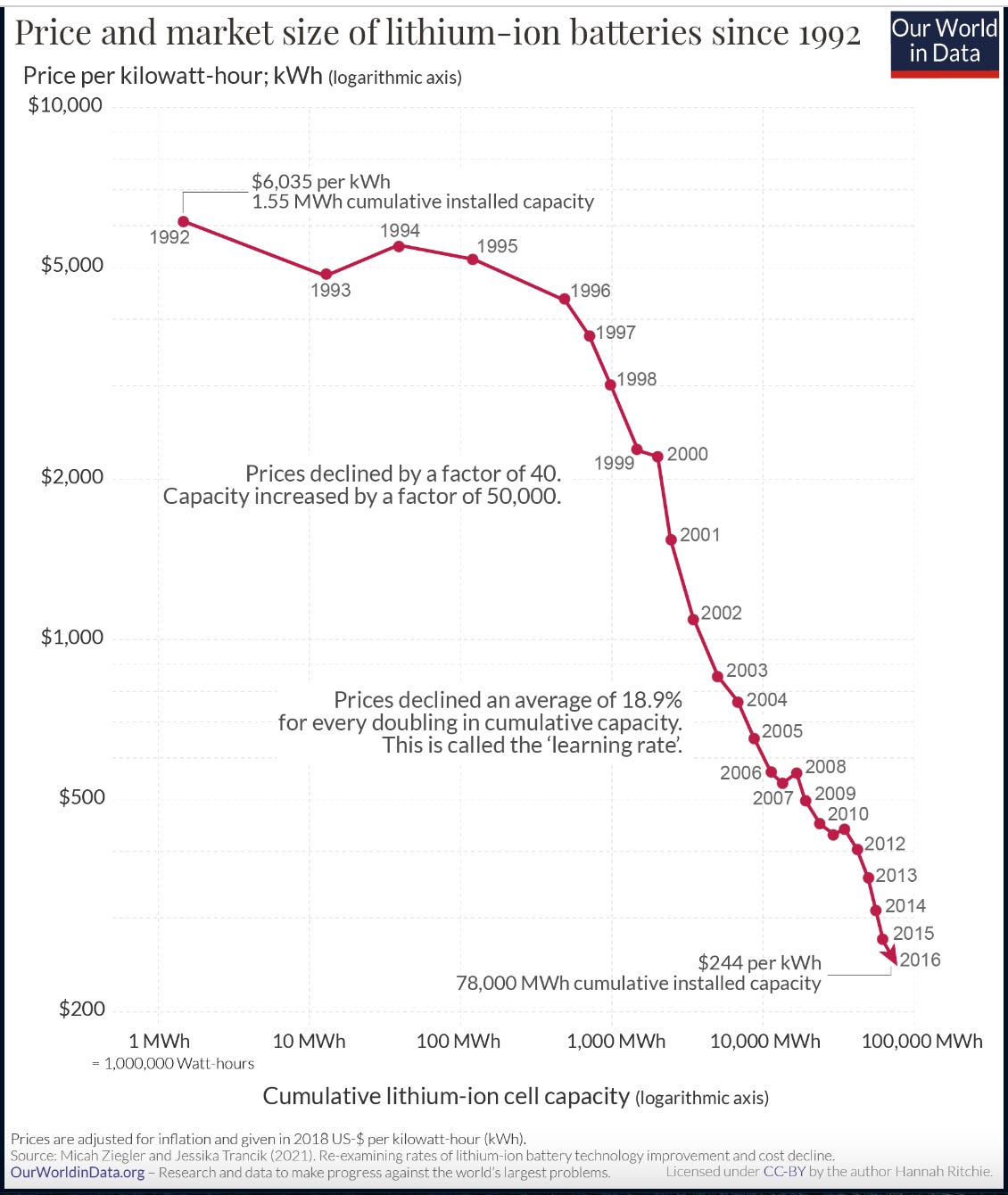

In the case of Tesla, Elon Musk rode the wave of battery-tech improvements. Specifically, batteries followed a trend called Wright’s Law, a business law that observes certain technologies get consistently cheaper as production increases. We can see that battery prices consistently got cheaper by 20%, each time the world manufactured 2x more batteries. Elon’s contrarian insight wasn’t about the inevitability of EVs, but a strategy of funding long-term R&D bets using short-term revenues through a partnership with Daimler and building a high-end sports car. This strategy of funding R&D costs and others is aptly summarized in the Elon Musk Playbook by the Generalist.

Example: Crusoe & bitcoin mining

While most vertically-integrated innovation is born out of a physics-based breakthrough, sometimes the innovation is downstream of in consumer behavior.

Kyle, a friend and deep-tech investor at Unit.VC, provided a wrinkle to the exponential trend idea.

People are playing with Bitcoin/Ethereum and then all of a sudden there are resource constraints (compute/energy). This drives clever entrepreneurs to build bitcoin mining operations near geothermal vents, for example - Kyle (Unit VC)

Probably the clearest example of Kyle’s point is Crusoe Energy Systems , a recent unicorn that solves natural gas flaring by building mobile data centers to convert the wasted heat into AI compute.

Takeaway

For aspiring founders, the key takeaway is to pinpoint your search for ideas that follow exponential supertrends (e.g. internet usage, bitcoin adoption, batteries getting cheaper) and time the market accordingly.

Signal 2: Off-path indicator

While researching up and coming vertical integrators, I came across something odd. Many vertical integrators are preceded by a subtle, anomalous indicator that doesn’t align with the expected narrative of technology progress. This is the off-path indicator.

Example : Base Power

Base Power is a new startup trying to become a new Edison Power Co by building residential batteries. According to a NotBoring deep dive, the founders got their inspiration for their company when they realized that energy generation costs were decreasing, BUT transmission costs were increasing.

This was the catalyst that revealed an opportunity to use batteries to balance the grid.

Example : Kurion - Nuclear Waste

Kurion , a Lux Capital incubated nuclear waste company and found its aha moment when it realized that the energy industry was spending an enormous amount on nuclear waste clean up ($1 in $4 spent). This was the catalyst that led them to recruiting a team to solve the company themselves.

Takeaway

The off-path indicator is still a working theory which requires more validation. But my hunch is that on the backs of each major technological shift, new problems or inefficiencies will appear that hinder the full utilization of a technology. These can be spotted with off-path indicators (i.e. a metric that makes you think “hmm something is off”).

The existence of an off-path indicator reveals a weak spot in existing infrastructure to accommodate new technology, which is exactly what needs to exist for vertical integrators to succeed. Therefore, predicting vertical integrators is an exercise of squinting to see these anomalies and making a judgment call on whether or not this anomaly will continue to exist in the next decade.

Signal 3 : Ground zero conditions

As Packy points out, startups often assume that existing incumbents are slow & incompetent, but this is often the wrong assumption.

Often incumbents can spot both an exponential indicator and an off-path indicator. So what enables a startup to compete and ultimately win?

Honestly, this question is incredibly hard to answer because it’s impossible to survey dead incumbents and ask “why didn’t you compete more effectively?”. The best framework I’ve seen for attributing disruption is Clayton Christen’s theory of disruption and Hamilton Helmer’s counter-positioning theory.

Christensen’s theory of disruption says that incumbents will ignore new products that do not serve their primary customers. Overtime, however, the new product evolves on new attributes and those new attributes become important for the incumbent’s primary customers. Similarly, Helmer’s counter-positioning theory states that incumbents ignore technologies/products that might cannibalize their existing business.

Here is an articulation from Flo Rivelli, on why Kodak lost to digital cameras.

Why Tesla disrupted automakers

In the case of Tesla, my own interpretation is that auto-companies didn’t compete with Tesla for two reasons. First, building EVs required significant R&D investment before the ROI was well-defined. Second, building EVs would cannibalize existing revenue lines because EVs directly competed with gas-powered vehicles. Third, EV adoption required a paradigm shift in infrastructure, from gas stations to charging networks, a foundational redesign that automakers were not structurally prepared to support. As a result, Tesla and traditional automakers started from roughly the same point in building EV infrastructure and technology; incumbents had no structural advantages that would allow them to easily outcompete Tesla, and the opportunity wasn’t so obvious that it justified a full-scale pivot.

Takeaway

In startup terms, investing in EVs for traditional automakers would be more akin to a hard pivot than simply increasing average contract values (ACVs) with new product features. Incumbents are typically averse to such pivots where they’re stepping into an entirely new market where their established systems and expertise don’t provide a competitive edge. Forces like counter-positioning and Clayton Christensen’s disruption theory only reinforced this reluctance, as competing with Tesla meant sacrificing their profitable, legacy business to enter an untested, capital-intensive market.

Conclusion

This essay started with a desire to answer 2 questions for myself

What signals foreshadow the rise of a vertical integrator?

How can founders and investors identify these signals early and use them to build / invest in their own vertically integrated startups?

From this exploration, I identified 3 signals that hint at the rise of vertically-integrated startups.

Exponential indicator : an exponential trend on which the product will be built

Off-path indicator : a metric or phenomenon that feels “off” that suggest a problem

Ground-zero conditions : an environment where incumbents cannot effectively compete

I’ll be honest though. As a founder, I’m still unsatisfied because while this essay shows what to look for, it doesn’t answer the important question of how to look for the idea. In other words,

How can an aspiring founder be intentional and actively create ideas that will become vertically integrated startups?

Right now, I have no idea. But I’m on my journey to build my own vertically integrated startup and I intend to find out if this is possible. The how will be the theme of the next few essays, where we’ll dive into how other successful founders have done it in the past and dig into case-studies of VCs who are actively incubating vertically integrated startups from scratch.

If you’d like to follow along my journey of building a vertically integrated startup, please consider subscribing!

Shout outs

Thank you Kyle O’Brien (Unit VC) for the discussion and shaping of these ideas. Thank you Paloma Van Tol, Theresa for reading drafts and providing feedback.