Welcome to Startup ROI! I’m Kyle O'Brien, an early stage deep tech investor — alongside

— and community builder based in Paris, France. I write what I see. These days, it’s mostly explorations into various categories of interest including:The Future of Computing

Blockchain Infrastructure (Privacy & Encryption)

Frontier Health

I enjoy taking complex topics and reducing them into accessible articles and top-notch memes. I also throw bangin’ dinner parties for cool people in tech and venture.

Alright, bruv — let’s get started 🇬🇧

The Mighty Boosh

My close friends know I have an esoteric hankering for off-beat, 2000’s era, British comedy. I’m not sure how I fell in love with this wacky, irreverent sub-genre, but I did. It’s an acquired taste, to be sure, but arguably some of the weirdest and best sketches of the past two decades have emerged from this category. All of this to say, it sometimes feels like a twist of fate that I ended up in Paris and not London as a tech emigré. London is Europe’s largest “tech hub” and notably, they speak English. Combining my obsession with quirky British comedy, it seems like the odds should have been in London’s favour. Nevertheless, I’m glad I became the token anglophone ex-pat in Paris tech. However, a trip across the channel every so often certainly scratches an old itch that lingers beneath the surface.

In the months since starting my role as a deep tech venture investor, I’ve had hundreds of calls with founders, co-investors and potential LPs. As expected, a large proportion are based in the UK. European deep tech tends to have centres of gravity in areas with a high density of high-caliber universities dedicated to engineering, maths and the sciences. Thus far, this roughly maps to the UK, France, Germany and Switzerland (there are some exceptions in the Nordics & Eastern Europe, but I’ve had less of an opportunity to engage with these geographies!). Long story short, I felt it was about time to find an excuse to get over the London and start building relationships with future collaborators. I started with an “anchor” event and built my schedule around it, resulting in dozens of meetings and a few after hours events. It was tremendously productive, yet fairly exhausting — Paris can feel positively pastoral in comparison to the urban sprawl of London.

During my time there, I scribbled some notes and decided it might be worth fleshing them out for a rather improvisational piece. If you don’t care to read further, please enjoy this clip from the iconic, titular sketch show, The Mighty Boosh:

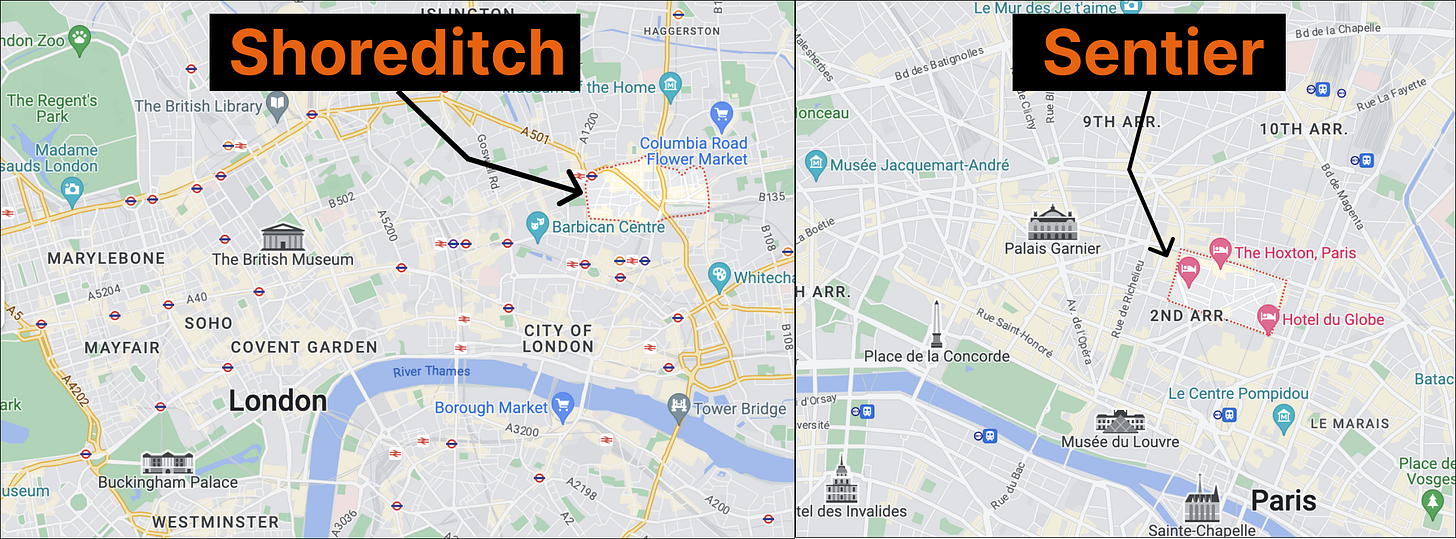

Shoreditch v Sentier

Naturally, I picked Shoreditch as a home base for the week. The “Brooklyn of London” (pron. Brük-leen by my French peers) and buzzy, central tech hub spared me a few tube trips, but certainly didn’t eliminate them. I found myself having breakfast meetings at The Hoxton, a frequent haunt of French tech networkers in Paris as well (located where else but the Rue de Sentier). For non-Paris people, Sentier is the neighborhood known for housing a dense population of startup offices. Despite some similarities, there were some distinct differences worth appreciating.

Culture

London shares Metropolis vibes with NYC (but with a functional public transit system), the sprawl of Los Angeles (minus the infuriating bumper to bumper traffic) and the arts/culture/food scene of Paris (just more expensive). It’s distinctly international in that it feels like a revolving door of people coming and going. A class of career-driven and upwardly mobile people, moving fast and moving on.

Paris is unapologetically Parisian. Despite an uptick in entrepreneurship, the culture of savouring long lunches and taking even longer holidays hasn’t faded (not necessarily a bad thing, btw!). There’s an energy here, but it’s not frenetic. It’s intentional, crafted and aligned with the moral/philosophical identity of La France. Despite less density/volume and a propensity for an examined life (again, not a critique), there is an energy to be harnessed and directed toward building community and accelerating great innovation — a subject I discussed with Roxanne Varza over dinner a couple weeks back (casual flex).

Brexit Blues

I got the sense that the post-Brexit hangover was really starting to settle in. The imminent coronation of Prince King Charles only served to further highlight the outdated institutions and bizarre politics of a once dominant empire. In conversations with London locals in tech, they seemed slightly embarrassed about the situation but not deterred from maintaining “pole position” in EU tech. Maybe there’s an opportunity for Paris or Berlin to overtake, but more likely, I think the UK’s political foibles present an opportunity for more/closer collaboration with continental Europe. Something that felt distant, unnecessary, even undignified on their pre-Brexit high-horse.

Deep Tech IRL

There was an abundance of after hours activity in London that I don’t see as often in Paris. This likely ties back to culture: in Paris, you reserve apéro for friends and family. Almost every night there was someone or a group of people down to trek across London to join an event. I co-hosted a Blockchain Infrastructure cocktail hour, joined an Angel/LP drinks event, and caught up with several people 1:1 after work, to discuss… work (and life!). I even joined a deep tech pitch event at a university. It felt foreign (haven’t seen much of this in Paris, am I not on the invite list?) but it was a worthwhile use of my time.

I may be talking my own book here a little bit in the sense that I’m also trying to build community through unique, curated and engaging events in Paris. If Parisian happy hour is reserved for friends, then I’ll have to go the extra mile and provide experiential networking events that don’t feel like your typical, awkward meet and greet at the mediocre bar on the corner. The trip to London reinforced my excitement for what I’ve dubbed the DM Dinner Club — our next event is on Thursday, May 11th, register here!

Access, Selection, Traction & Hope

I met a seasoned angel investor turned VC/board advisor for a wide-ranging conversation on all things investing. While there were many areas worthy of highlight, there were four words I couldn’t get out of my head after I left the meeting: access, selection, traction and hope. These four words surfaced at different points in the conversation, in pairs, and for one reason or another felt connected.

Access and selection represent the two key functions of any early stage investor. Access to information, deals, key personas (i.e. founders and co-investors). Access typically comes from network and the compounding effects of positioning yourself within a network over time. It’s definitely not easy, but with enough effort, patience and affability, a determined emerging manager can achieve access. Once you have access, the problem becomes selection. How do you choose the right companies? At the early stage it can be both an art and a science. Nevertheless, developing a thesis, qualifying criteria and a decision framework is critical (especially at scale!).

I saw a great post from Empath Ventures recently on their technical due diligence checklist. Depending on what category you invest in, technical due diligence can be make or break. In our case (#deeptech), it’s crucial to understand the business model, capital requirements, timelines to market and defensibility. It’s all about putting yourself in front of the right information streams and manipulating said information with the edge/perspective you bring to the table. This brings us to traction and hope.

The origin of this pairing is:

In a bull market, you bet on hope. In a bear market, you bet on traction.

I’m not sure who exactly it’s attributable to, it might even be an amalgam of many quotes in one. But the sentiment is particularly poignant in the current climate. Hope, inspiration, narrative, storytelling — these are the necessary building blocks of a successful fundraise but often substitute real diligence in a roaring economy. Once things go sour, traction is the only “safe bet” investors are willing to make. Therein lies the problem for early stage investors: most pre-seed companies don’t yet have traction. They might not even have a product. So how do you square that circle? Most investors don’t (hence the precipitous drop in venture funding last quarter). If you really do have access, (good) selection capabilities, and conviction, then hitting the pause button is a mistake. Prices have reverted to the pre-zero-interest-rate era, the herd has been culled and only mostly the bold are taking the risk of starting something in the peak of a downturn.

The way I see it, the next year will be focused on amplifying access, refining selection, identifying attributes that lead to traction post R&D and maintaining a hopeful outlook on what should be an eventful decade in tech.

Always good to see what is on your mind.