Welcome to Startup ROI, where I, Kyle O'Brien, share European Tech insights from my perch in Paris, France. You can expect to find articles covering startups & ecosystem trends, interviews with founders and investors, as well as updates on in-person events for community thought leaders.

Want to sponsor or collaborate? 📩 bonjour@startup-roi.com

Join hundreds of fellow tech enthusiasts & follow for in-depth analysis:

It's Pronounced “GWAY,” N00b

I'll be the first to admit that if you need to explain your joke, it's likely not a very good joke. So I'm not off to a good start. The title of the this article is a pun involving John Denver's, Rocky Mountain High (1972) and a denomination of the cryptocurrency Ethereum, known as GWEI.

What Is Gwei?

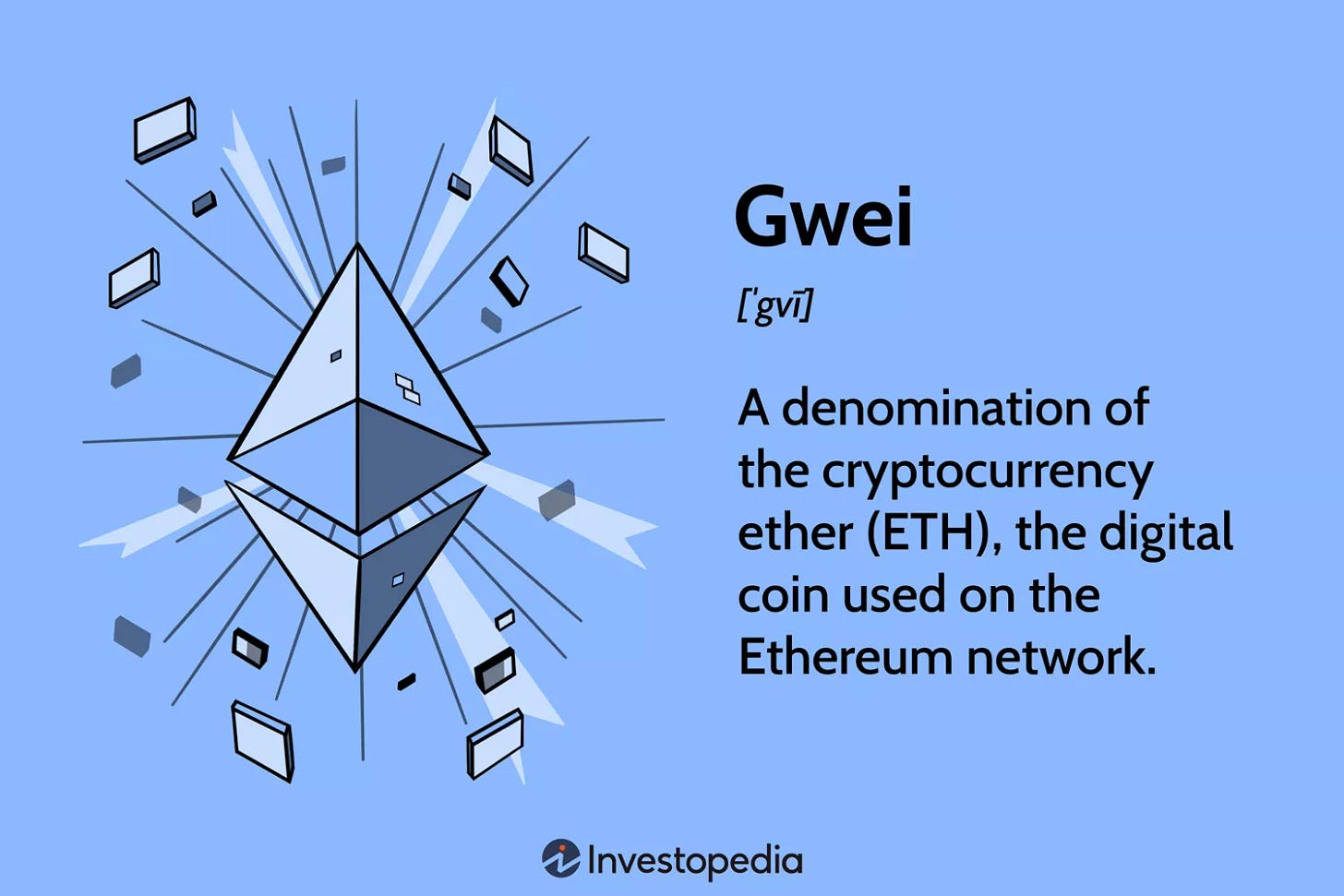

Gwei is a portmanteau (a blend of words) of giga and wei. Gwei is a denomination of the cryptocurrency ether (ETH), the digital coin used on the Ethereum network. Ethereum is a blockchain platform, like Bitcoin, where users transact to buy and sell goods and services without a middle man or interference from a third party.

Similar to fiat currencies like the U.S. dollar or euro, ether is broken into denominations. Wei is the smallest denomination of ether, like cents are to the U.S. dollar. However, while there are 100 cents in a dollar, there is one quintillion wei (18 zeros) to one ether; there are one billion gwei to one ether.

I'm told it's pronounced gway. Tell me I'm crazy, but that sure as hell looks like a gwhy to me… Either way, I wanted to sort this out before we covered the main topic today: ETHDenver.

To be completely frank, I had never heard of this conference (ETHDenver) before a few months ago. I consider myself fairly well-informed, maybe less so on all things crypto, but I figured it would have come across my radar. It was mentioned off-hand at a Jericho.gg event here in Paris and the next thing you know I was on a flight to Denver. In the subsequent paragraphs, I'll give my impressions as a veritable outsider to the crypto ecosystem.

There are three main areas to cover:

Millenial Grievances

DAOs All the Way Down

Just the Tip (of the Iceberg)

Millenial Grievances

I was an infant during the early days of the Dot Com Boom and a high schooler when SaaS and Social came into their mature adolescence. So I can only speculate (and read up) about how these emerging phenomenon were perceived at the time. My hunch tells me that establishment players turned their nose up at the pesky innovators trying to eat their lunch. And they weren't completely wrong — the technological graveyard is littered with dot com failures, SaaS wannabes and social media zombies. Nevertheless, many succeeded at changing the world (for better or for worse). It's hard to imagine the future while it's being built. I think back to 2005-era Salesforce when Oracle executives said no one will put their business data in the cloud — welp, take a look at the growth since then… Salesforce is practically a household name and everyone puts their data in the cloud. Everyone.

As a millennial born in the latter half of the generation, I feel a strange tension between 2010s era tech innovation and the emerging Gen Z model. I want to sympathize with and support the up-and-coming disruptors. But at the same time it feels foreign. It doesn't help that high profile scams (read: SBF and FTX) lend credence to the establishment talking points. I was worried that I'd attend ETHDenver and experience a living meme-scape of coin-shilling hucksters and Bitcoin maximalists looking like they just stopped over from Burning Man. Don't get me wrong, they were there. But in very small proportion. The whole just put it on the blockchain mantra wasn't the central thesis. It felt more like (how I imagine) the early internet days were like: highly experimental and iterative. The original philosophic tenets around decentralization, self-sovereignty, and anti-censorship remain, but they present as a pragmatic remedy to big tech writ-large as opposed to some manifesto from an anarcho-communist cult. What am I getting at here?

Fundamentally, I think the millennial allergy to crypto and blockchain stems from cultural, not technological, grievances.

The “kids” these days talk in memes and jargon that are less familiar and thus foreign to a previous generation accustomed to setting the tone. The overwhelming criticism from my millennial peers is that “most of these projects are bullshit” — which, quite honestly, can be said of the dot com boom and SaaS era as well. The crypto scene is still finding its footing. The technology is just a decade old and rapid progress and development only legitimately started 5 years ago. I can tell you first hand that some of the smartest technologists, developers and academics I know have gotten into the field. Many pulled away from high-paying “big tech” roles in service of something even bigger. There may be froth. There may be fraud. But there's some fantastic research that I'm confident will set in motion the next wave of digital transformation.

The lesson here is simple. Don't get intimated (or embarrassed) that you don't understand the culture. Look at the technology and embrace the culture to whatever extent you can. Can you imagine what the “suits” first thought when Zuckerberg walked into a conference room in a grey hoodie? Now replace that hoodie with an Off-White tie-die shirt and some Gucci slides. Be an ally not a detractor. It could be the next wave. Or as the crypto community says: probably nothing…

DAOs all the way Down

A DAO — decentralized autonomous organization — sounds intense and futuristic. But under the hood, it's basically just a crypto-native company structure. As someone whose recently gone through the rigmarole of lawyers, administrators and regulatory bodies required to form a fund entity, I see the appeal of something a bit more 21st century. My impression is that for the first time in a long time, young people are excited about economic incentives, game theory and governance principles — admittedly unsexy topics. But when wrapped in the ever fashionable blockchain, it takes on a new meaning and seems to provide endless possibilities.

Not all DAOs are created equal. Many aren't even completely decentralized at present. But in my view, this experimentation is valid. In fact, it may be one of the best near-term, practical applications for blockchain technology. Issuing shares, triggering rule-based payments/compensation, voting collectively and pseudonymously — all programmatically and without the need (eventually) for a team of lawyers and administrators. I don't think every LLC should make the transition today. But there's something here. Some of the most promising early applications I've seen are in the funding space, specifically alternative methods for science funding.

I attended a morning session at DAO Denver focused on Decentralized Science (DeSci) and it was pretty eye-opening. Ultimately, science funding appears to be broken, and DeSci offers a remedy. Academic bureaucracy, misguided public policy and barriers to entry (for funders and scientists) make it hard to work on problems that are either (a) under-represented or (b) moonshots that are high-risk, high-reward. Here are a few of the projects I found most compelling:

Gitcoin for grants programs

Molecule for research on the future of medicine

LabDAO for research in the computational sciences

OpSci for publishing credentialed research

HairDAO for solving hair loss

You might think the last one was a joke like I did. But it was seriously one of the best talks I saw all week.

Just the Tip (of the Iceberg)

Apologies in advance for the crass title. I couldn't resist. If you work in tech, you are probably aware of the classic iceberg analogy. In the physical world, 90% of an iceberg is under the surface. You only see 10% of it. Which is often the case with new technology. Consumers see the application layer, the end product, but rarely interact with (or understand) what's beneath — note: my business partner, Rand, wrote a great piece titled The AI Layer Cake that highlights this exact phenomenon. That is most certainly the case with blockchain and crypto. I've created a basic illustration below to make my point.

If you live on Twitter or have dabbled in crypto investing you've no doubt seen the Bored Apes NFT project or opened a Coinbase account. But just below this front-end layer are complex DeFi Liquidity Pools, enterprise-grade analytics and vertical blockchain projects to support your web3 art collection. But even one layer further down we have the genuine infrastructure layer. The cryptography, mathematics and hardware devices that power the networks and trading that ultimately underwrite the assets that most people actually interact with. I attended a workshop targeted specifically at the people working on this 3rd layer and it did not disappoint.

If you are in need of a humbling experience, I highly recommend joining a group of PhDs and 10x developers working on the fundamentals holding this burgeoning ecosystem together. I witnessed a lot of breakthrough science — purpose-built accelerator hardware for cryptography from Zero RISC, the world's fastest ZK-AI prover in game form from Modulus Labs and optimal designs systems for decentralized intelligence. But by far the biggest take-away was that zero knowledge proofs will underpin the future of crypto.

In cryptography, a zero-knowledge proof or zero-knowledge protocol is a method by which one party (the prover) can prove to another party (the verifier) that a given statement is true while the prover avoids conveying any additional information apart from the fact that the statement is indeed true.

In the past 6 months, the technology has gone from theory to practice and everyone wants in. This is one sub-set of cryptographic techniques that appears highly valuable at scale — along with multi-party computation and fully homomorphic encryption. My goal here isn't to show off my own intelligence, in fact, just the opposite. There is so much to learn beyond the surface level. These sessions are what solidified my belief that blockchain technology and cryptography are the next wave of the internet — whether you like it or not. For me, it means there's a lot more to do. More reading, more conversations, and ultimately more writing to crystallize the concepts I come across. And I plan to do this the way I always have:

ETHDenver Honorable Mentions:

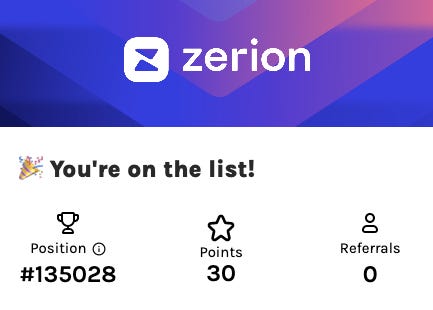

✨ Zerion Wallet — I'm slightly biased here because my new expat buddy is Head of Growth here (👋🏼 Hey, Alex!) but this is the first crypto wallet experience that I've actually enjoyed. I just assumed Metamask was the only way. Anyways, if you're fed up with your current wallet, sign up for their browser extension waitlist here. Only 135,027 people in front me!

🪩 Disco.xyz Merch — Disco is popularizing the idea of carrying around your very own data backpack 🎒It's an identity management tool for web3 and their CEO gave a great presentation at the conference. Most importantly, however, they have some awesome merch. If you're reading this and happen to have an account, please send a GM to this address [did:3:kjzl6cwe1jw146tcz23t1jxv9c7hag8wvbvtc27ufp55kw92pngu7joxcrzrh7i] — I'm 8 away from earning this amazing hat!

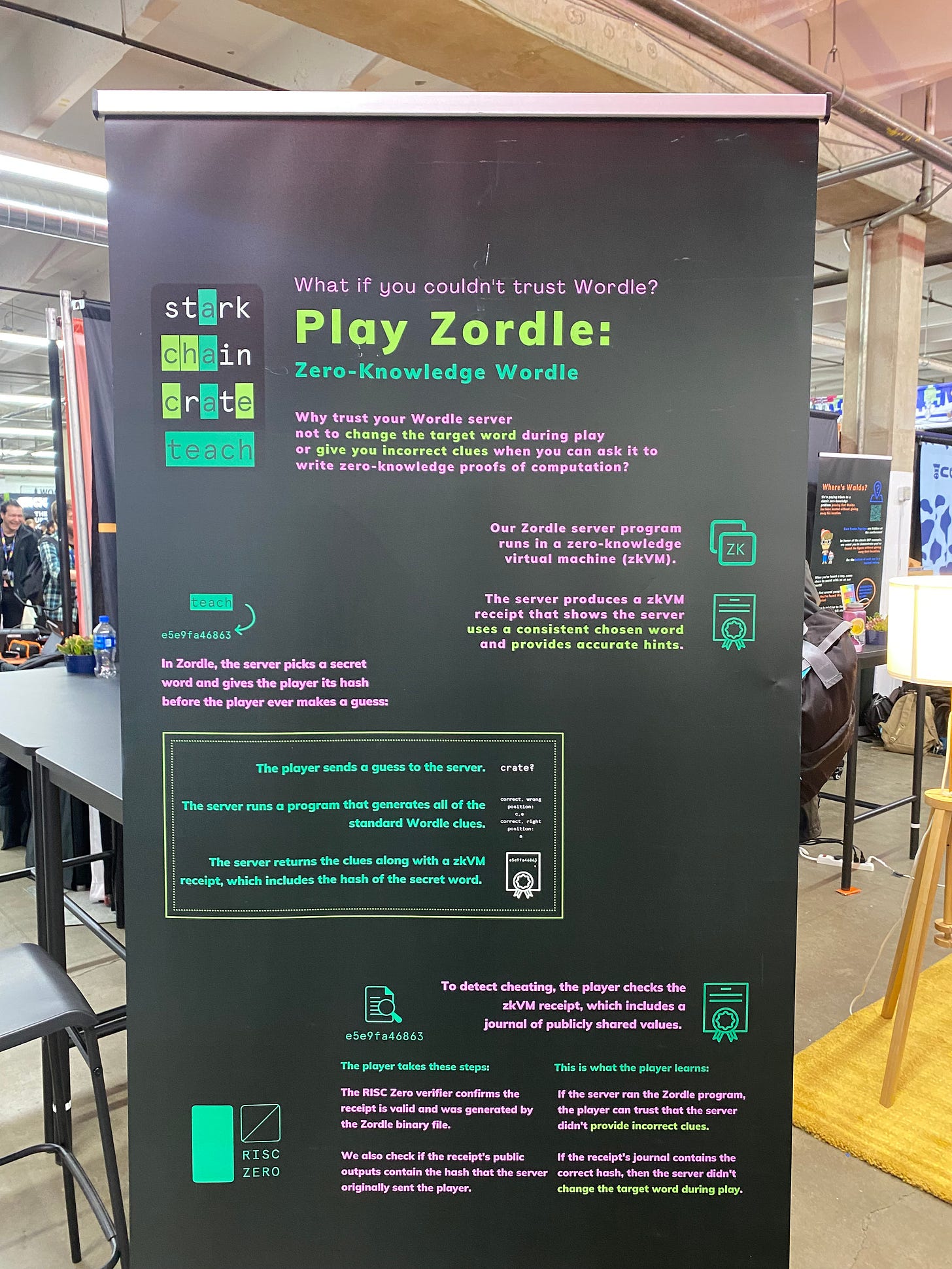

🧠 ZK Wordle by RISC Zero — Wordle has peaked culturally. I'm not sure how it infiltrated the culture. But it did. And now it's a booth game at a crypto conference illustrating zero knowlege principles.

Really like seeing you get into the weeks of crypto!